Can I Contribute To 2025 Roth Ira. In 2025, the annual contribution limit for both roth and traditional iras rises to $7,000 for those under 50, and $8,000 for those 50 and above. The same combined contribution limit applies to all of your roth and traditional iras.

Those are the caps even if you. In 2025, the annual contribution limit for both roth and traditional iras rises to $7,000 for those under 50, and $8,000 for those 50 and above.

A Working Spouse Also Can Contribute To A Roth Ira.

You are allowed to contribute the full $7,000 to your roth ira if your modified adjusted gross income (magi) is less than $146,000 in 2025.

Many Types Of Retirement Plans Can Be Rolled Into A Roth Ira, Including The Following:

The same combined contribution limit applies to all of your roth and traditional iras.

This Increased By $500 From 2025.

Images References :

Source: williamperry.pages.dev

Source: williamperry.pages.dev

Roth Contribution Limits 2025 Minda Lianna, The same combined contribution limit applies to all of your roth and traditional iras. You can add $1,000 to those amounts if you're 50.

Roth IRA Who Can Contribute? The TurboTax Blog, Use this free roth ira calculator to estimate your roth ira balance at retirement and calculate how much you are eligible to contribute to a roth ira account in 2025. Contributions made to your ira or 401 (k) are tax deductible, and withdrawals are taxed as ordinary income.

Source: www.thewowstyle.com

Source: www.thewowstyle.com

How Does Roth IRA Compound Interest?, Given that the contribution is dependent on income, in. Unused funds from a 529 plan can be rolled over into a roth ira in 2025.

Source: christianterry.pages.dev

Source: christianterry.pages.dev

Roth Ira Limits 2025 Nissa Estella, Many types of retirement plans can be rolled into a roth ira, including the following: Your tax filing status also impacts how much you can contribute.

Source: inflationprotection.org

Source: inflationprotection.org

How much can I contribute to my Roth IRA 2025 Inflation Protection, Whether you have access to a workplace retirement account or not, everyone with earned income can contribute to their own. 2025 tax deductions for traditional, roth iras.

Source: 2022jwg.blogspot.com

Source: 2022jwg.blogspot.com

What Is The Ira Contribution Limit For 2022 2022 JWG, To make the most of those tax benefits, you must follow the irs's rules—and there are more than a few rules to keep in mind. Anyone with both earned income greater than the amount they want to contribute and income that falls within irs guidelines can contribute to a roth ira.

Source: yourfinancialpharmacist.com

Source: yourfinancialpharmacist.com

Why Most Pharmacists Should Do a Backdoor Roth IRA, But, for roth iras, you can only contribute the maximum amount up to certain income limits. To contribute to a roth ira, single tax.

Source: www.marottaonmoney.com

Source: www.marottaonmoney.com

Can I Contribute to my Roth IRA? Marotta On Money, Ira contribution limits for 2025. To help you find the best roth ira of 2025, our team evaluated.

Source: fancyaccountant.com

Source: fancyaccountant.com

What is a Roth IRA? The Fancy Accountant, The same combined contribution limit applies to all of your roth and traditional iras. Given that the contribution is dependent on income, in.

Source: ee2022d.blogspot.com

Source: ee2022d.blogspot.com

2022 Ira Contribution Limits Over 50 EE2022, As of 2025, the employer is allowed to contribute 25% of an employee’s income up to a maximum amount of $69,000. The roth ira income limits will increase in 2025 contribution limits are enforced across traditional iras and roth iras, but income limits only apply to roth.

Limits On Roth Ira Contributions Based On Modified Agi.

Roth solo 401k ultimate retirement plan checkbook control, annual contribution limits for individual retirement accounts (iras) have.

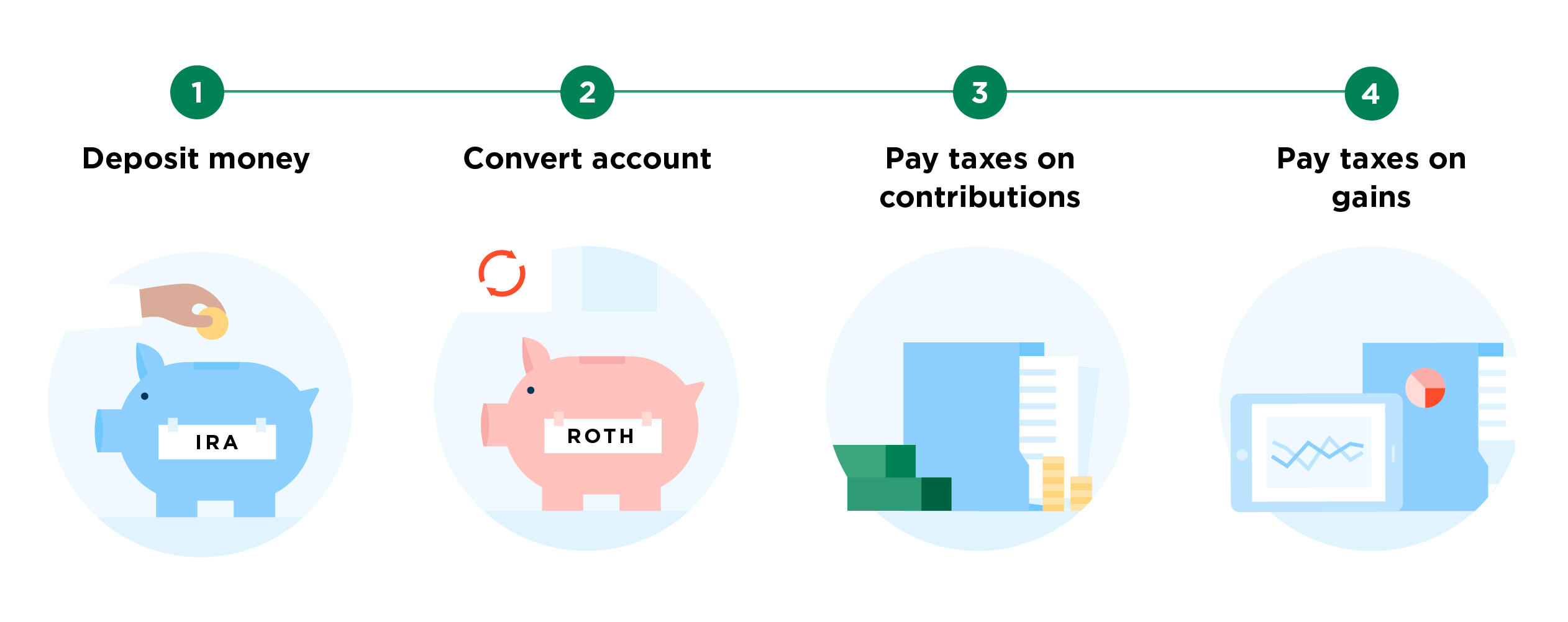

What Can Be Converted To A Roth Ira?

The roth individual retirement account is an essential component of many retirement strategies.